Summary

- CoStar enjoys high-quality recurring revenues that hit new highs on a quarterly basis.

- Management remains hungry for acquisitions, while the company's cash-cow business model can easily afford future buyouts.

- While the stock's valuation may seem hefty, the company's qualities, excellent financials, and consistent growth should fairly justify it.

- Looking for a helping hand in the market? Members of Wheel of Fortune get exclusive ideas and guidance to navigate any climate. Get started today »

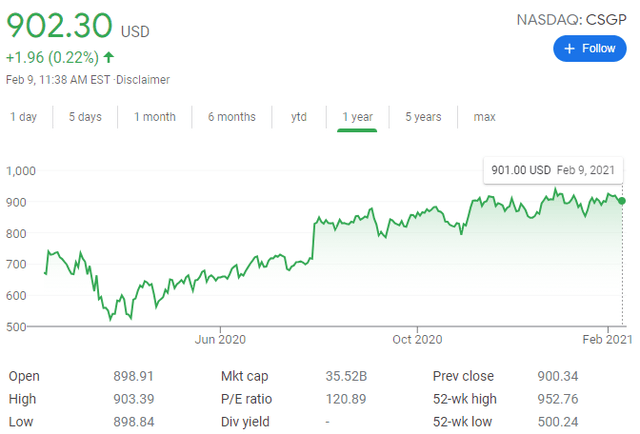

Back in August, we had published an article on CoStar Group (CSGP), sharing our thoughts on why the stock remained investable despite its prolonged rally. Since then, the company has made some noteworthy advancements, such as acquiring Homesnap, while its shares have rallied by an additional 8.5%. With its earnings release approaching February 22nd and the stock currently hovering near its all-time high levels, it feels like a fitting time to go back to CoStar's investment case and see how it compared to our last one. Source: Google finance

Source: Google finance

As a reminder, CoStar is the industry leader of real estate information, analytics, and online marketplaces to the commercial real estate industry in the United States and the United Kingdom. The company portfolio includes some of the most prominent websites in the space, such as

- Costar.com

- Apartments.com, and

- Landsofamerica.com

- Bizbuysell.com, and its newest addition,

- Homesnap.com

Financials and recent acquisitions

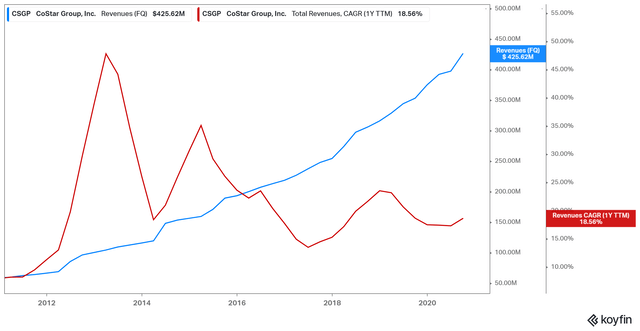

While we are waiting for the company's Q4 results later in the month, we can rely on the company's previous report in this article, which once again highlighted CoStar's resilient growth despite the ongoing pandemic. Quarterly revenues continued their non-stop trajectory upwards, hitting a new quarterly high of $425M. This figure represents a growth of 21%, which is higher than the company's current TTM (1Y Trailing Twelve Month) rate of 18.56%, suggesting no signs of a potential slowdown in growth, despite the overall challenges caused by the pandemic in the commercial real estate sector.

The company's revenues are truly high-quality, not only because of their persistent growth but because they are all subscription-based, flowing into the company in a recurring and predictable schedule. As a result, the company has not reported a single quarter with weaker revenues than its previous one for over 10 years straight.