Summary

- Ciena recorded its first quarterly contraction in years and guidance calls for another one in Q1.

- Ciena managed to score gains elsewhere despite encountering challenges, including higher margins leading to higher profits.

- While Ciena is currently dealing with headwinds, it's optimistic they will be overcome in time.

- Ciena could be a good bet in the long run, but valuations and prevailing uncertainty make it more of an iffy one in the short term.

Ciena Corporation (CIEN) got pummeled after its Q3 report when it signaled the arrival of an industry-wide slowdown, despite some big gains in terms of the bottom line. The stock has yet to fully recover, although it has recouped most of its losses and heading in the right direction. It was hoped that the Q4 report would shed some more light as to how Ciena is doing. However, the Q4 report is sending mixed signals. Why will be covered next.

Q4 FY2020 quarterly report

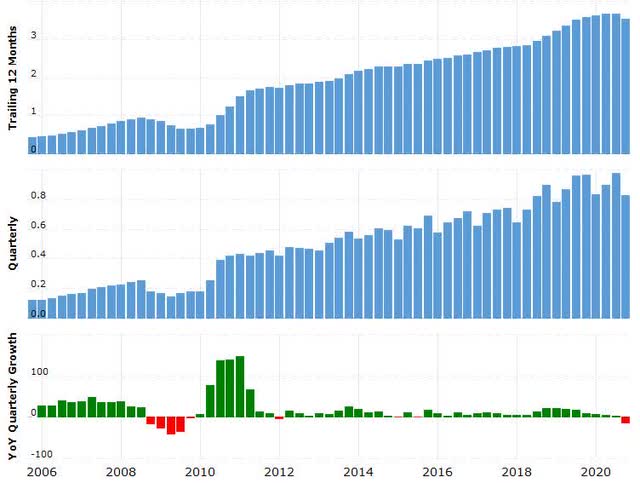

Ciena had warned of a coming weakening in demand and there are signs of it in the Q4 report. Q4 revenue declined by 14.4% YoY to $828.5M. Net income declined by 19% YoY to $65M on a GAAP basis, but it increased by 4.5% YoY to $94.5M using non-GAAP as shown in the table below. Margins improved by several hundred basis points YoY. To top it off, Ciena announced it will re-institute its share buyback program, starting in Q1 of FY2021.

| (GAAP) | Q4 FY2020 | Q3 FY2020 | Q4 FY2019 | QoQ | YoY |

| Revenue | $828.5M | $976.6M | $968.0M | (15.16%) | (14.41%) |

| Gross margin | 48.8% | 47.6% | 43.4% | 120bps | 540bps |

| Operating margin | 11.3% | 19.3% | 9.6% | (800bps) | 170bps |

| Income from operations | $93.5M | $188.0M | $93.2M | (50.27%) | 0.32% |

| Net income | $65.0M | $142.3M | $80.3M | (54.32%) | (19.05%) |

| EPS | $0.42 | $0.91 | $0.51 | (53.85%) | (17.65%) |

| (Non-GAAP) | |||||

| Revenue | $828.5M | $976.6M | $968.0M | (15.16%) | (14.41%) |

| Gross margin | 49.5% | 48.2% | 43.8% | 130bps | 570bps |

| Operating margin | 15.8% | 22.4% | 13.3% | (660bps) | 250bps |

| Income from operations | $130.9M | $219.3M | $129.2M | (40.31%) | 1.32% |

| Net income | $94.5M | $166.4M | $90.4M | (43.21%) | 4.54% |

| EPS | $0.60 | $1.06 | $0.58 | (43.40%) | 3.45% |

Source: Ciena Form 8-K

With the Q4 numbers in, so too are the numbers for the whole year. FY2020 revenue decreased by 1.1% YoY to $3.53B and non-GAAP net income increased by 38.7% to $460.1M as shown below. FY2020 was not a bad year all things considered. There were significant gains, especially in terms of profitability.