Summary

- Novavax's COVID-19 vaccine has shown efficacy in clinical trials. Late-stage trials could commence within days.

- NVAX's vaccine can be stored at refrigerated temperatures. Mass doses could potentially be easier to distribute vis-a-vis PFE or MRNA.

- The stock trades at 2x projected 2021 COVID-19 revenue. This is less than the 6.5x revenue AZN paid for ALXN.

- Once NVAX's vaccine comes to market, the stock could bounce. The COVID-19 play is intact. Buy NVAX.

- This idea was discussed in more depth with members of my private investing community, Shocking The Street. Get started today »

The race to provide a COVID-19 vaccine to the masses is heating up. Last month Pfizer (PFE) divulged clinical trials showed its COVID-19 vaccine had 95% efficacy. Moderna's (MRNA) vaccine practically matched Pfizer's efficacy, and both recently received emergency use authorization. The question remains, "Where does that leave Novavax (NVAX)? According to analysts from Bernstein, Novavax could garner $4 billion of the $39 billion COVID-19 pie in 2021:

In fact, the top five players are set to divvy up about $38.5 billion in sales, Bernstein analysts figure, with the first-to-market companies reaping more than half of that. Pfizer, which just won U.K. approval Wednesday, is in line for $14.3 billion in COVID-19 vaccine sales next year, followed by $10.9 billion for Moderna, $6.4 billion for AstraZeneca, $3.9 billion for Novavax and $3 billion for Johnson & Johnson, according to the projections.

After a huge haul in 2021, the analysts predict the market will dwindle to around $6 billion in 2025, assuming vaccine recipients need a booster every three years. Along the way, the team of analysts project $23.1 billion in total COVID-19 vaccine sales in 2022, $12.6 billion in 2023 and $8.5 billion in 2024.

Analysts project the market could decline to $23 billion in 2020, $13 billion in 2023 and about $6 billion by 2025. The economic impact of an effective vaccine is much bigger than vaccine sales. General Electric (GE), Macy's (M), Wabtec (WAB) are several vaccine-levered stocks expected to benefit from rising transportation and retail sales after the economy reopens.

Potential Impact On Novavax

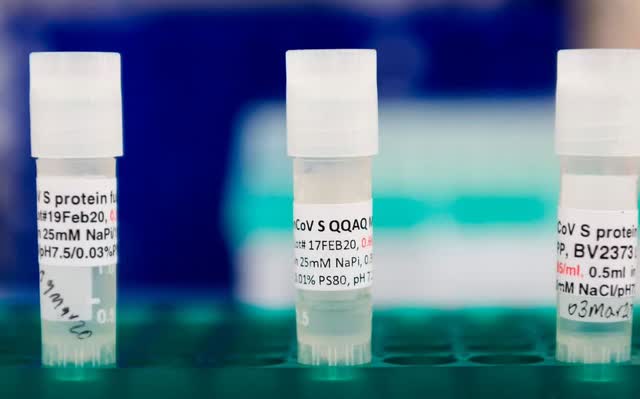

Novavax develops innovative vaccines to prevent infectious diseases and address urgent global health needs. The company has two drugs in late-stage development. Its NVX-CoV2373 is designed to treat Middle East Respiratory Syndrome ("MERS") and Severe Acute Respiratory Syndrome ("SARS"). Its ResVax vaccine is being developed to protect infants via maternal immunization against respiratory syncytial virus ("RSV"). Its COVID-19 vaccine showed effectiveness in monkeys and the company is moving to test the effectiveness of the vaccine on humans:

In the monkey study, the researchers did not find any evidence of the virus in the noses of the animals. The virus replicated in the lungs of a single monkey that received the lowest vaccine dose. The monkey that had viral replication in the lungs was able to combat the infection within just four days.

The investigators of the Novavax COVID-19 vaccine study said the vaccine generates robust antibodies capable of creating “sterile immunity.” Ultimately, this prevented the virus from moving from the lungs to the nose and halted the transmission of the virus from monkey to monkey.

Novavax is still trying to complete late-stage clinical trials for its vaccine, amid questions over its plans to partner with Fujifilm Diosynth Technologies for commercial-scale manufacturing. Its clinical trials have been delayed into late December or early January 2021. If Novavax generates $4 billion in COVID-19 revenue in 2021, it is unclear if its revenue will decline in 2022. Analysts expect total COVID-19 revenue to fall over 40% to $23 billion.