Summary

- Altimmune went up on unsubstantiated reports of Covid-19 work where its key asset is NasoVAX.

- The company also has interests in such diverse distractions like NASH, Hep B, solid tutors and so on.

- Altimmune should focus on its core asset, NasoVAX.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Get started today »

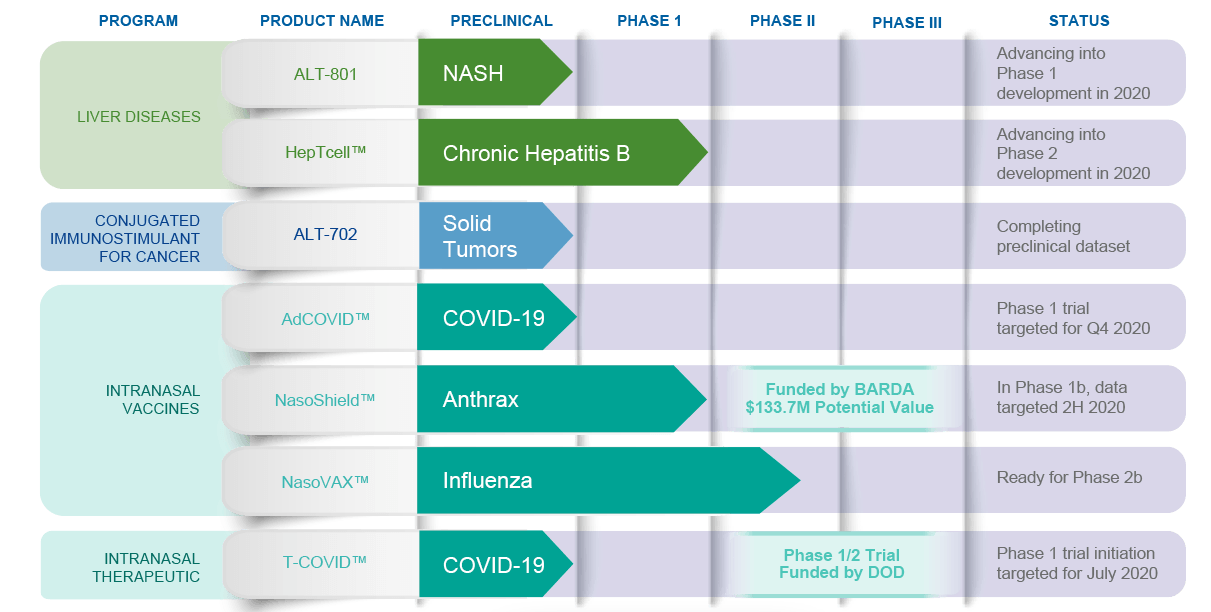

Altimmune (ALT) is an influenza vaccine developer - this is how I will characterize it now - that has recently had a good run riding the Covid-19 wave. While the stock has now settled down, lingering effects of the joyride still remain - a bit of dizziness, a little of lightheadedness, and the funny feeling that maybe we can conquer the world with our pipeline, which looks like this:

But if you look at it closely, you can see that this pipeline is mostly what accountants call bill padding. This $400mn company with about $200mn in cash is not going to find treatments for all sorts of incurable diseases like NASH, Hepatitis B, solid tumors etcetera as well as various antivirals at one go - not today, probably not ever. Yet it has this show of strength in its pipeline, and it looks impressive - but looks are deceptive.

I have neither the time nor the inclination to pursue every indication they have on this list and show why I think it doesn’t make sense. Especially since most of them do not have enough data anyway. My point is just this - most microcaps that do well do so when they stay focused. That’s how you develop depth. It takes a huge effort just to target one of these indications properly. NASH, for example, is a mega-billion-dollar market where not a lot of proper development is happening. Altimmune could have targeted just NASH. Solid tumors are another such area of oncology where a lot remains to be done. Altimmune could have just addressed solid tumors. It tries to do everything, and when that happens, I doubt if anything will be done well.