Summary

- Qiagen has been a beneficiary of COVID related tailwinds particularly as related to COVID testing, which has driven strong revenue growth and profitability.

- Several new products set to come to market in early 2021 alongside strong testing demand that should remain stable in the near-term will drive upside compared to Q4 guidance.

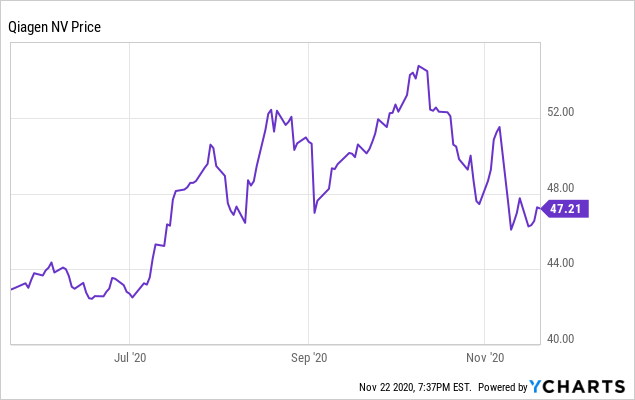

- Stock has recently sold off due to vaccine news, which has provided a good entry point for a short-term trade ahead of Q4 results.

Introduction and Investment Thesis

Qiagen (QGEN) is a leading provider of a diversified set of molecular diagnostics and molecular sample/assay solutions serving over 500,000 customers across a variety of end markets including life science R&D, healthcare, and industrial applications.

These solutions are used to conduct a variety of genetic and proteomic analyses from COVID testing to oncological tumor typing. In terms of the revenue mix, around 89% of sales are recurring sales based on consumables with the remainder being system sales. This large recurring revenue base provides the company with a degree of revenue stability and makes the company less exposed to more episodic and lumpy system sales. In terms of end-market exposure, the company is evenly split at roughly 50% of revenues each between more traditional life science/pharma market and molecular diagnostics.

The key driver of value in recent months is COVID related business. Here, Qiagen is well-placed across the entire stack to take advantage of testing trends. To start, the company provides the core DNA/RNA extraction technology necessary to process samples at high throughput. Qiagen also provides the PCR technology and testing kit necessary to identify positive COVID cases with high sensitivity and specificity. Additionally, Qiagen's antigen test will likely be approved this quarter with commercialization happening in the first half of next year. This is another possible positive value driver for the company. All in all, COVID made up $164MM of revenues in Q3 or nearly 35% of the mix, which more than made-up for the drop in non COVID related revenues of ~8% YoY. And although vaccine related developments such as the new clinical results from Pfizer may eventually dim the need for diagnostic tests, the high rates of infection should still provide a stable base of testing volume in the near-term. Furthermore, it will take time for vaccine volumes to ramp and reach the population. Additionally, it is still questionable what the true level of uptake of a vaccine in the general population truly will be. Thus, I believe that testing volumes should remain at least stable through the next year.

Looking at Q4 and into early next year, the company will be launching new COVID related products including a fast/high throughput integrated test (QIA prep & amp) that will likely drive a strong ASP increase of as much as 2x compared to the simpler test the company currently markets. This is not to mention the new antigen test that should provide an ultra portable and fast test for COVID. This antigen test, I believe, will help boost volumes given its speed and low barriers to utilization. Qiagen's antigen test, assuming approval, will begin commercialization in the new year. These factors, combined with my belief that volumes should remain stable in the near-term, drives my thinking that a short-term re-rate in the stock is possible.