After my previous series of articles on Sinclair (SBGI) I was challenged by other Seeking Alpha readers who argued that I had incorrectly classified some of Diamond Sports Holdings’s (the subsidiary holding the RSNs) preferred equity as having recourse to Sinclair, when in fact they did not. We actually got pretty deep into the issue, but none of us were able to persuade the other.

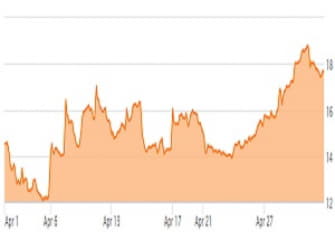

With Sinclair’s market capitalization currently hovering around $1.7 billion, after falling below $1 billion, the disposition of a $1.025 billion preferred equity stake is significant to say the least. If it has recourse to Sinclair itself and its broadcast TV division, that's a very different financial picture than if it does not. I decided to do some intensive SEC research to see what the terms of this equity investment are.

READ FULL ARTICLE HERE