Today Arcadia (previously Arcadia Power) announced the closure of a $30M Series C funding round to accelerate the consumer technology company's mission of providing simplified and equitable clean energy access to all Americans. The round is led by G2VP with participation from new investors Macquarie Group and Seek Ventures, and existing investors Mitsui USA, Energy Impact Partners, BoxGroup, and ValueAct Spring Fund. The funding follows a year of rapid growth for Arcadia, now the largest residential community solar manager in the country. The company saw 300 percent revenue growth in the last year and now manages 4.5 terawatt-hours of energy demand.

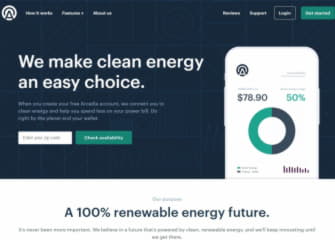

In 2020, the company has immediate plans to expand community solar access from four to eight states, release new energy subscription pricing models, and incentivize customers to use smart home devices to lower and shift their energy consumption. The company is also rebranding from Arcadia Power to Arcadia - a change that aligns with the company's current and future market position and goal of providing a complete home energy platform.

At a time when corporate giants are making headlines for purchasing renewable energy, Arcadia meets the rapid rise in consumer demand for clean energy. The amount of renewable electricity being voluntarily bought has increased nearly 300 percent since 2010. And, in 2018, the majority of Americans stated they would choose wind and solar over fossil fuel energy. Arcadia makes this choice simple and accessible for customers in all 50 states.

"Arcadia unlocks residential demand for clean energy by providing simple and compelling products to the customer," said Greg Callman, Global Head of Energy Technology at Macquarie Capital. "Behind the scenes, renewable project developers, trading desks, technology players, utilities and capital providers can connect and manage the complexity. We're thrilled to be involved, and to leverage capabilities across Commodities and Global Markets, Macquarie Capital and the Green Investment Group, which is entirely focused on making green projects happen."

Arcadia's technology works by bridging the gap between consumers, producers of clean energy, and utilities. The company's data and billing platform manages consumer utility accounts to bundle clean energy, energy efficiency tools and products, rate monitoring, and more in a single, unified account experience. Just as fintech companies like Wealthfront or Mint.com have helped users make smart financial decisions, Arcadia takes the guesswork out of making better energy choices. Members reduce their carbon footprint by 50 percent just by signing up, and members in open energy markets experience 20 percent average savings on their monthly energy bill compared to traditional retail suppliers.

"Consumers are demanding a new type of home energy service that is fossil-fuel free, efficient, and easy," said Kiran Bhatraju, CEO of Arcadia. "Giving people an option to support clean energy is one of the fastest ways to decarbonize our grid and in order to do that at scale, we have to make sure everyone – in all 50 states – can participate. I'm incredibly proud to be one of the few companies in energy focused on accessibility and equity, and we're excited to be joined by the best investors in energy on this journey to decarbonize the grid one power bill at a time."

About Arcadia

Arcadia makes choosing clean energy easy. As the only nationwide tech company focused on consumer energy, Arcadia's software manages consumer utility accounts to bundle clean energy, energy efficiency tools, rate monitoring and more in a simplified, modern account experience. Founded in 2014, the company's platform now integrates with more than 125 utilities in all 50 states, manages 4.5 terawatt-hours of residential energy demand, is the largest residential energy broker in the country, and manages the most community solar subscribers in the U.S. For more information, visit www.arcadia.com and follow us on Facebook, Twitter, and Instagram.

About G2VP

At G2VP, we invest in emerging technology companies that digitize traditional industries and drive market transformations. Tapping into global industries from transportation, energy and agriculture to manufacturing and logistics, G2VP was founded around a multi-trillion-dollar trend: the digitization of industry. As this trend takes root, and industries worldwide transition from traditional analog to digital processes, G2VP sees tremendous opportunity for value creation, economic growth, and sector disruption. By aligning companies, purpose and profit, we aim to unlock previously unidentified paths to sustainability and resource efficiency.

About Macquarie Group

Macquarie Group Limited (Macquarie) is a diversified financial group providing clients with asset management and finance, banking, advisory and risk and capital solutions across debt, equity and commodities. Founded in 1969, Macquarie employs over 15,700 people globally. Macquarie's assets under management (AUM) at 30 September 2019 were $A563.4 billion. For further information, visit www.macquarie.com.