Summary

- The stock represents good value with an estimated upside of 20.30% with a target price of $45.78.

- Strong segment growth opportunities through 5G in the Networking Platforms and the Software/ Software-related Services segments.

- A $2BN global opportunity expected through rapid consolidation of small optical companies. Ciena is a growing leader in core optical and packet networks.

- High demand for the first 800G system in the market.

- Macro Impact: The Tech Sector experienced collateral damages from the exposure in China, end-market demand constraints and pricing declines. However, Ciena has little to no direct China exposure and has been taking market share (See figure4,5) with not significant pricing erosion.

Editor's note: Seeking Alpha is proud to welcome Roseanne Son as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA PREMIUM. Click here to find out more »

We recommend a Buy rating on Ciena Corporation (CIEN). The stock represents good value with an estimated upside of 20.30% with a target price of $45.78. The upside potential is driven by: 1) Strong segment growth opportunities through 5G in the Networking Platforms and the Software/ Software-related Services segments; 2) A $2BN global opportunity expected through rapid consolidation of small optical companies; 3) High demand for the first 800G system in the market. The risks to our recommendation and target price include a narrow customer base, slower-than-expected sales of new products, and increased competition. In the next three years, the company projected Ciena’s revenue to grow at 6-8% and earnings are expected to grow at 23.7%. Margin upside opportunities exist through gross margin upside and high operating leverage. With a flawless balance sheet, Ciena continues to grow at above-market rates with a positive outlook and undervalued shares.

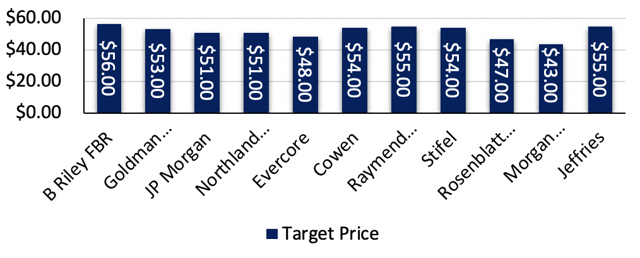

Analyst ratings are as follows:

Figure 1: Analyst Consensus

Source: Bloomberg IntelligenceAnalysts (B Riley FBR, Goldman Sachs, JPMorgan, Northland Securities, Evercore, Cowen & Company, Raymond James, Stifel, Rosenblatt, Morgan Stanley, Jeffries) target a price range from $43.00-56.00, which supports the DCF target price of $45.78.

Source: Bloomberg IntelligenceAnalysts (B Riley FBR, Goldman Sachs, JPMorgan, Northland Securities, Evercore, Cowen & Company, Raymond James, Stifel, Rosenblatt, Morgan Stanley, Jeffries) target a price range from $43.00-56.00, which supports the DCF target price of $45.78.

Business Overview

Ciena Corporation is a network strategy and software company which provides solutions that enable an extensive range of network operators to deliver services to businesses and consumers. They provide network hardware, software and services that support the transfer of switching, aggregation, service delivery and management of voice, video and data traffic on communication networks. The solutions are used by communications service providers (Verizon (NYSE:VZ) and AT&T (NYSE:T)), cable and multi service operators, web-scale providers, submarine network operators, governments, enterprises, research and education (R&E) institutions and other emerging network operators. The software business manages the development and licensing of network management software and software-related services that support hardware offerings. Ciena Corporation offers consulting programs and support services that help customers to design, optimize, deploy and maintain their communications networks.