Summary

- Ciena delivered a strong beat-and-raise quarter with very healthy service provider and enterprise revenue growth in North America.

- Europe remains a longer-term opportunity; Ciena's lagging market share could improve as countries move away from Huawei equipment.

- Ciena's margins can support a fair value closer to $50, but this is a stock that has given investors many second chances in the past.

Between strong deployments from Tier 1 and Tier 2 service providers in North America and healthier trends among enterprise customers than seen by chip companies like Xilinx (XLNX) and Intel (INTC), Ciena (CIEN) had a great fiscal second quarter. Better yet, between a strong competitive position at 800G, ongoing growth in segments like submarine deployments, and opportunities to gain share in Europe, I don’t believe Ciena has exhausted its growth potential.

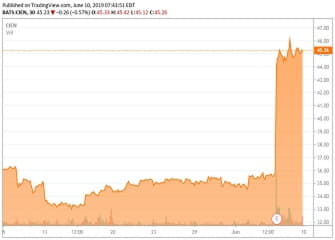

I’ve been generally bullish on Ciena for a while now, and there are at least some metrics by which the shares are still undervalued. I like to buy stocks like Ciena when they slip below my long-term DCF-based fair value (which is now near $40), and Ciena has been volatile enough that I don’t think it’s entirely unreasonable to think there will be more “buy on a pullback” opportunities. Still, management is executing well on its opportunities, leading to share gains and improving margins.