Summary

- Today, we look at an interesting small-cap developmental concern with a couple of compounds in late-stage development.

- This developmental concern is well-funded and getting increasing positive analyst commentary of late.

- A full investment analysis is provided in the paragraphs below.

- Looking for a portfolio of ideas like this one? Members of The Busted IPO Forum get exclusive access to our model portfolio. Get started today »

"There's a fine line between genius and insanity. I have erased this line." - Oscar Levant

In this in-depth article, we look at a rare disease concern that has been public for some five years now. It is focused on the rare disease space. The company has a couple of compounds currently in late-stage development.

Company Overview

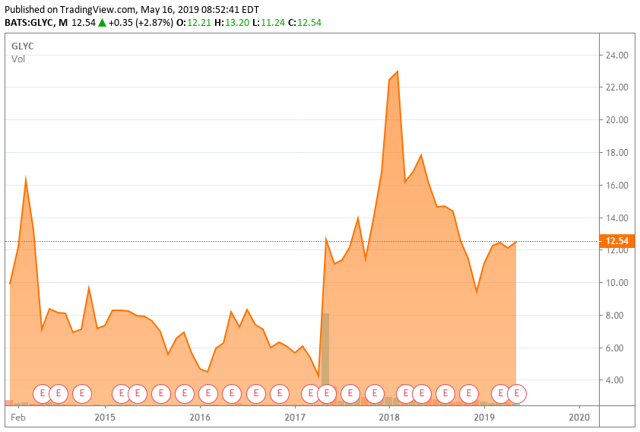

GlycoMimetics (GLYC) IPO'd in 2014 and is a Rockville, Maryland-based biotechnology company. The company is dedicated to developing therapeutics that improve the lives of patients with orphan diseases. The company is advancing drug candidates that target selectins, adhesion molecules that play a role in the inflammatory response in a wide array of conditions. The company's pipeline centers around two late-stage clinical programs, Rivipansel and Uproleselan. GlycoMimetics has a market capitalization of roughly $540 million and trades for around $12.50 a share.