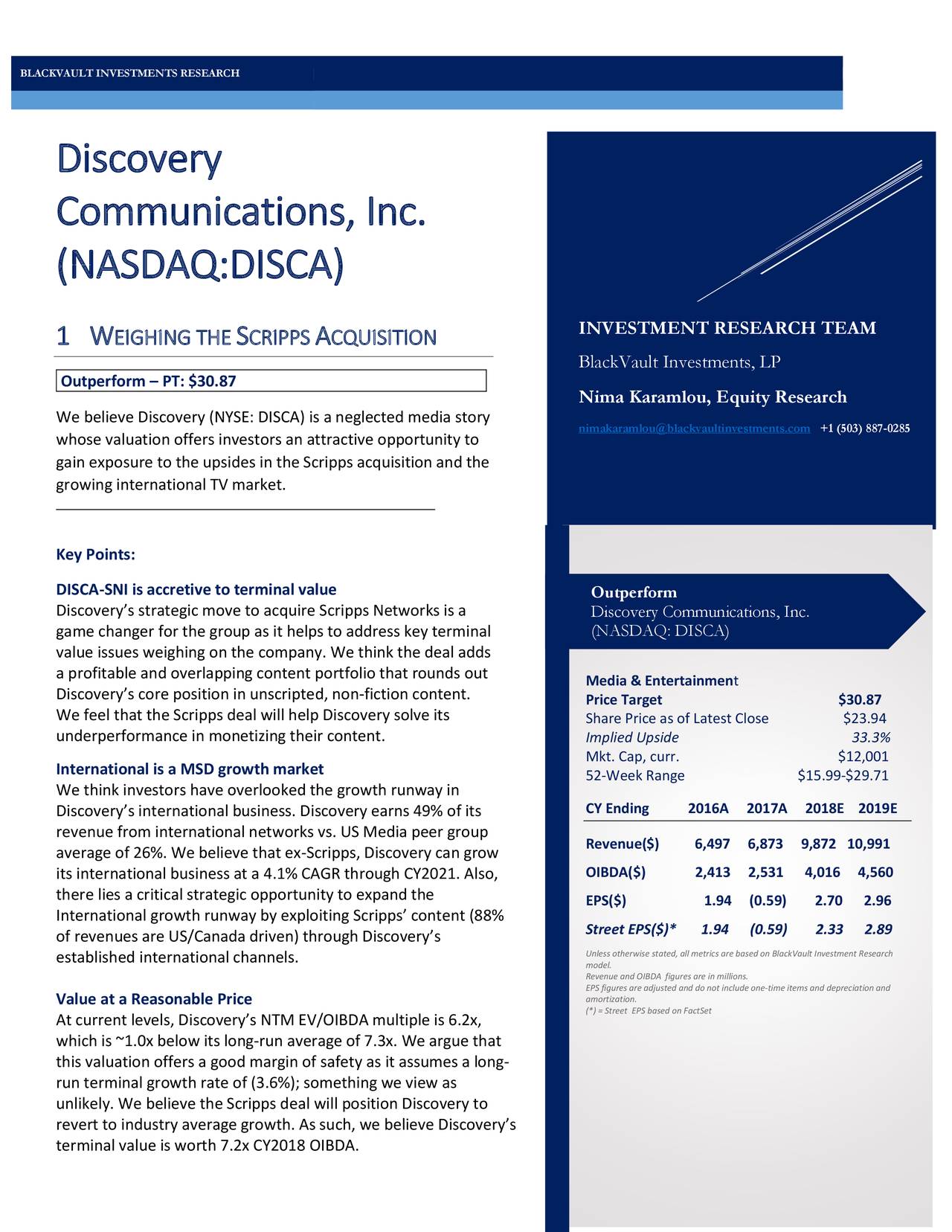

Following on our thematic coverage of the US Media space, we are issuing an outperform rating on Discovery Class-A shares given valuation and upside risks with Scripps integration.

Attached below is our research report on Discovery. If you would like to see more detail, please PM me for the model.