Real Estate Weekly Review

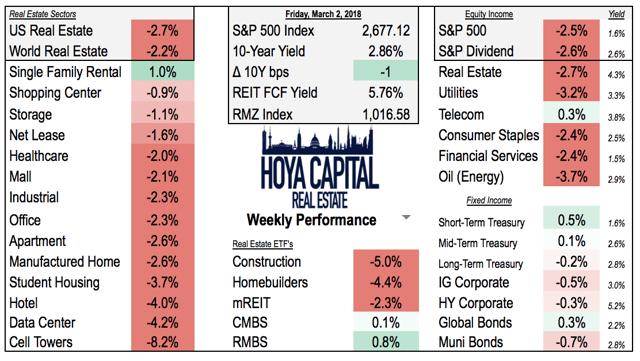

The real estate sectors continued their recent skid this week, dragged down by a broader equity market selloff that was sparked in part by the Trump administration's plan to increase tariffs on steel and aluminum, which sparked fears of a possible global "trade war." Investors fear that retaliatory measures from trading partners would result in higher prices, lower productivity, and slower economic growth. The S&P 500 (SPY) dipped 2.5% while bond yields remained roughly unchanged. The REIT sector (VNQ and IYR) retreated nearly 3% while homebuilders (XHB and ITB) fell more than 4%.

(Hoya Capital Real Estate, Performance as of 1pm Friday)

The 10-Year yield retreated slightly this week to 2.86% after reaching as high as 2.94% in recent weeks. Across other areas of the real estate sector, mortgage REITs (REM) and international real estate (VNQI) each declined 2%. REITs and homebuilders continue to feel the negative effects of rising interest rates. REITs are lower by 15% since the passage of tax reform while homebuilders are down 11%.