Alan Levenson

An intriguing part of the Fed’s Dec. 14 announcement that it would raise interest rates by 0.25% is the U.S. central bank’s forecast for an improved economy that is expected to increase job creation and inflation.

The Fed followed with tradition by avoiding a political debate and not mentioning the Nov. 8 election of Donald Trump as the next U.S. president as a reason for economic optimism. But a brightened outlook for U.S. economic growth comes with the knowledge that Trump has promised to implement change aimed at rebuilding America’s infrastructure, reducing regulatory burdens to spur private-sector job creation and cutting taxes to fuel additional business investment in the United States.

The markets have rallied since Trump’s election but the U.S. central bank, in keeping with custom, focused its comments on economic data and its latest projections. It thereby sidestepped potential political minefields.

Specifically, the Fed’s Dec. 14 statement reported that job gains have been solid in recent months and the unemployment rate has declined. The latest language also differed from the November update by mentioning that the “realized and expected” labor market and inflation gains led the Federal Open Market Committee (FOMC) members to vote unanimously this week to raise the target range for the federal funds rate from 1/2% to 3/4%.

The Fed indicated that its monetary policy remains “accommodative” to support further “strengthening” in labor market conditions and a return to 2% inflation from the latest U.S. inflation rate of 1.7% through the 12 months ended November 2016.

Alan Levenson, the chief economist of Baltimore-based investment firm T. Rowe Price, said the Fed’s actions reflect that labor market and inflation are a bit closer to its goals than had been anticipated in its previous summary of economic projections. The Fed’s language also indicated that it is a bit more confident that inflation will return to 2%, he added.

“Policies of the incoming Trump administration will not be reflected into the FOMC outlook until they are announced and implemented with greater clarity,” Levenson said. “I think 75 basis points of rate hikes next year is a reasonable expectation, with risks skewed toward an additional 25 basis point hike. I think the unemployment rate will end 2017 below 4.5%, and that risks to core inflation are skewed modestly to the upside of the 1.8% median forecast.

But Levenson said the FOMC's tolerance for core inflation above 2% is a key uncertainty.

READ FULL ARTICLE HERE

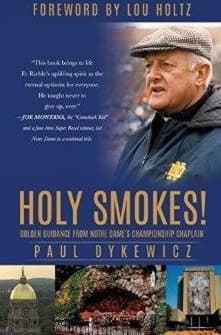

Paul Dykewicz is the editorial director of Eagle Financial Publications, editor of Stockinvestor.com and DividendInvestor.com, a columnist for Townhall and Townhall Finance, a commentator and the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a Foreword by legendary football coach Lou Holtz. His next appearance to sign and dedicate copies of his book will take place Saturday, Dec. 31, 11 a.m., Joyful Spirit Gifts, 3315 Lee Hwy., Arlington, VA 22207, 703-294-4142. Signed books also can be purchased at Curmudgeon Books, Marley Station Mall, 7900 Ritchie Hwy, Glen Burnie, MD, and Greetings and Readings, Hunt Valley Towne Centre, 118 Shawan Rd., Suit Aa, Cockeysville, MD. Visit Paul’s website at www.holysmokesbook.com and follow him on Twitter @PaulDykewicz.