Joel Kallett

Click here for Part I & Part II

A dynamic investment banking firm with a culture rooted in long-term growth and camaraderie

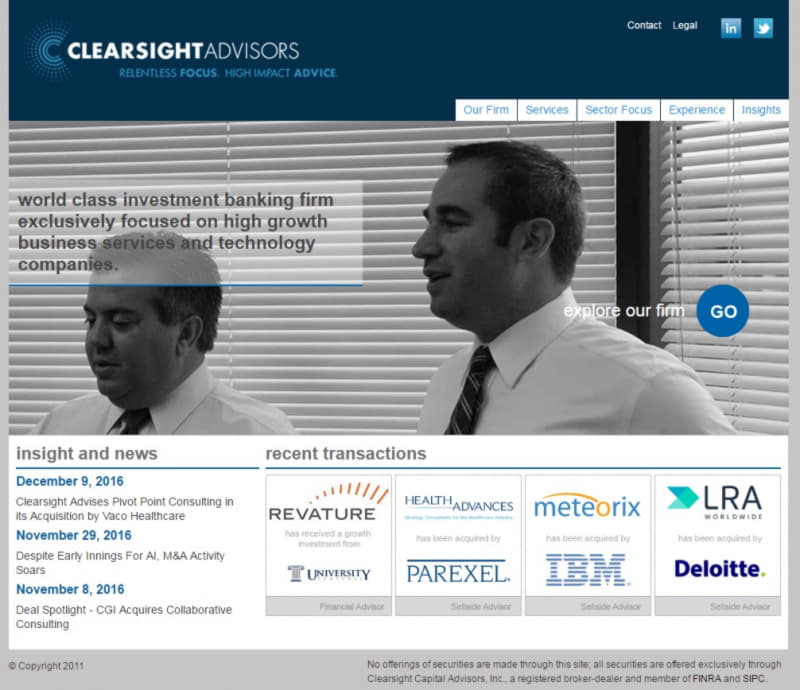

Joel Kallett is the CEO and Managing Director of Clearsight Advisors, an investment banking firm with offices in the DC metropolitan area and Dallas, Texas. Clearsight digs in deep to its work with its clients, emphasizing long-term strategic goals, tangible results, and insights that go above and beyond expectations. The firm has provided M&A and capital-raising advisory services to high-growth technology and software companies successfully acquired by organizations such as IBM, Accenture, and Ernst & Young. As of this writing, the latest company to benefit from Clearsight’s advisory services was Pivot Point Consulting, which was acquired by Vaco Healthcare in December 2016.

Joel Kallett spoke with citybizlist publisher Edwin Warfield for this interview.

EDWIN WARFIELD: Can you break down some of the ways Clearsight serves its clients?

JOEL KALLETT: At Clearsight, we provide our clients with a few different services, if you will.

The first and primary service line that we offer is M&A advisory. The majority of what we do as an organization today is focused on that. Somewhere between 60–70% of Clearsight’s activities are advising our clients in strategic M&A transactions. A portion of those will go to private equity sponsors, but the majority of our transactions are helping our clients find the right strategic fit that really unlocks more than financial value—but strategic value—for our clients. We lead them through that process and help them negotiate and optimize a transaction.

We also very deliberately and purposefully spend about 20–25% of our time focused on providing our clients with what we call “growth equity,” where we’ve a got a client that is looking to raise capital—you know, $25–100 million of typically expansion capital. They may want it to buy out a partner, they may want it to go do some M&A on their own, but they’re selling a minority slug versus a controlled slug in their business. These are private companies, not public entities. We’re effectively helping them lead a process to access that capital in the marketplace, find both the most favorable terms for that capital, but also the right partner—because they are bringing these private equity investors onto their board; they have to live with them. They’re getting married, in a sense. So, it’s not just about the money, but it’s the right money and a shared common vision.

The balance of what we do is really the strategic financial advisory, where we’re helping companies understand their current financial structure—should they be thinking about taking on debt, refinancing their debt? We’ve helped companies think about their own buy-side M&A strategies. We’re starting to do more and more from a merchant banking standpoint, where when we’re raising capital for companies we’re actually co-investing alongside some of the other investors.

So, when you look at the panoply of things that we do, today that’s the balance of where we spend our time and the services we offer, but we pride ourselves on being an entrepreneurial firm. We are constantly evaluating and seeking new ways to add value to our core client base with new services and things that we can offer them that are value-added.

Q. How does Clearsight differentiate itself from other investment banking and M&A advisory firms?

A. When we think about how to create Clearsight and carve out a path for ourselves—and a relevancy and a market niche—we believe that looking at some of the new markets, getting ahead of where we see future M&A opportunities and capital raising opportunities, is the best way for us to be strategic—to add value to our clients, to not be an also-ran. What I’ve found when I have looked at other new investment banking boutiques and mid market-focused firms is they tend to get lesser quality deals because the deals that they win are deals that the larger more established investment banks really didn’t want to focus on, because of the size parameters or some other hair on the transaction.

That’s not where we wanted to be. We wanted to be a leader in the markets that we pursued, and thus we didn’t want to jump into heavily crowded markets where everybody and their brother is already an established investment banking name, but to look at those markets where our skill set and our relationships were going to drive value for clients and would be growth areas going forward.

Connect with Joel on LinkedIn

Edwin Warfield, CEO of citybizlist, conducts the CEO Interviews.

If you're interested in reaching CEOs, please contact edwin.warfield@citybuzz.co

Connect on LinkedIn